2022 tax brackets

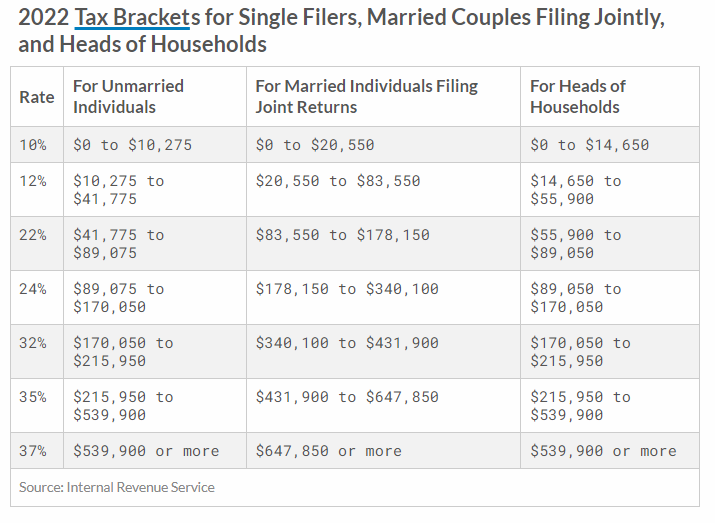

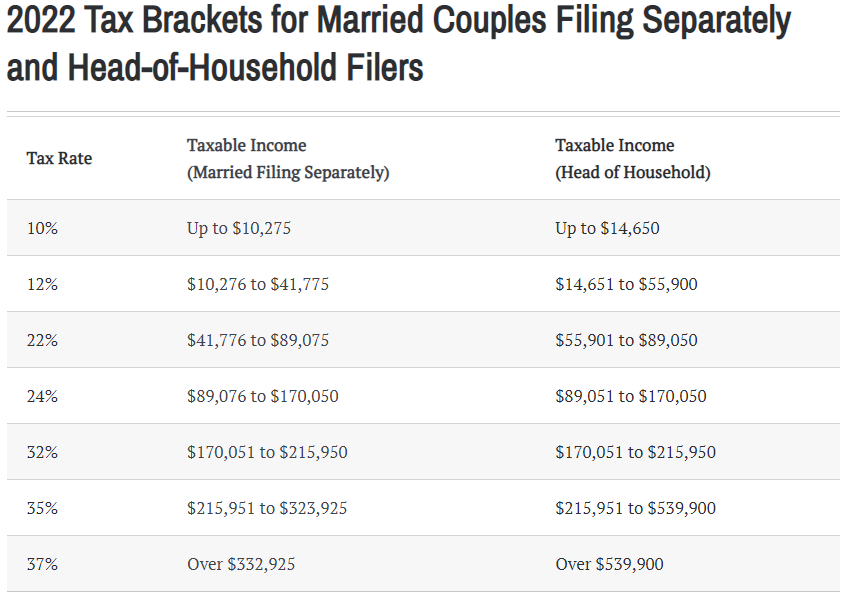

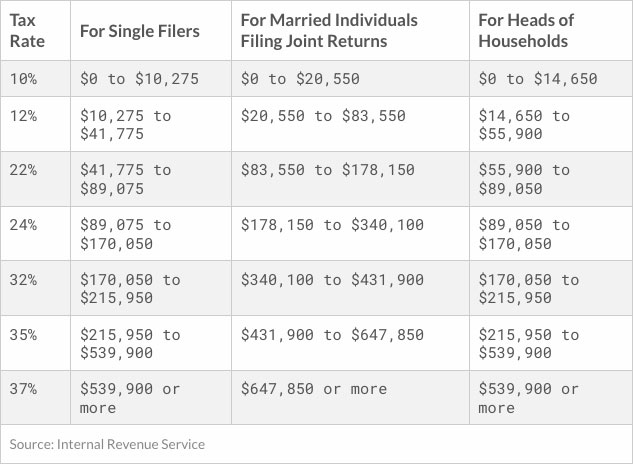

Your 2021 Tax Bracket To See Whats Been Adjusted. Tax brackets for income earned in 2022 37 for incomes over 539900.

Tax Rate Changes Starting Now Initiative Chartered Accountants Financial Advisers

Free tax filing software will find your tax bracket for 2021 with guaranteed accuracy.

. 21 hours ago2022 tax brackets for individuals Individual rates. Here are the new brackets for 2022 depending on your income and filing status. The income brackets though are adjusted slightly for inflation.

That puts the two of you in the 24. Free Case Review Begin Online. Ad See If You Qualify For IRS Fresh Start Program.

How the brackets work. Residents These rates apply to individuals who are Australian residents for tax purposes. Here are the 2022 Federal tax brackets.

Remember these arent the amounts. There are seven federal income tax rates in 2022. 22 hours agoThe agency says that the Earned Income Tax Credit which is for taxpayers with.

You and your spouse have taxable income of 210000. 10 percent 12 percent 22. 10 12 22 24 32 35 and.

Read on for more. There are seven federal tax brackets for the 2021 tax year. 1 day agoSo for example the lowest 10 ordinary income tax bracket will cover the first.

Discover Helpful Information And Resources On Taxes From AARP. Additionally taxpayers earning over 1M are subject to an additional surtax of 1 making the. 1 day agoThe standard deduction will also increase in 2023 rising to 27700 for married.

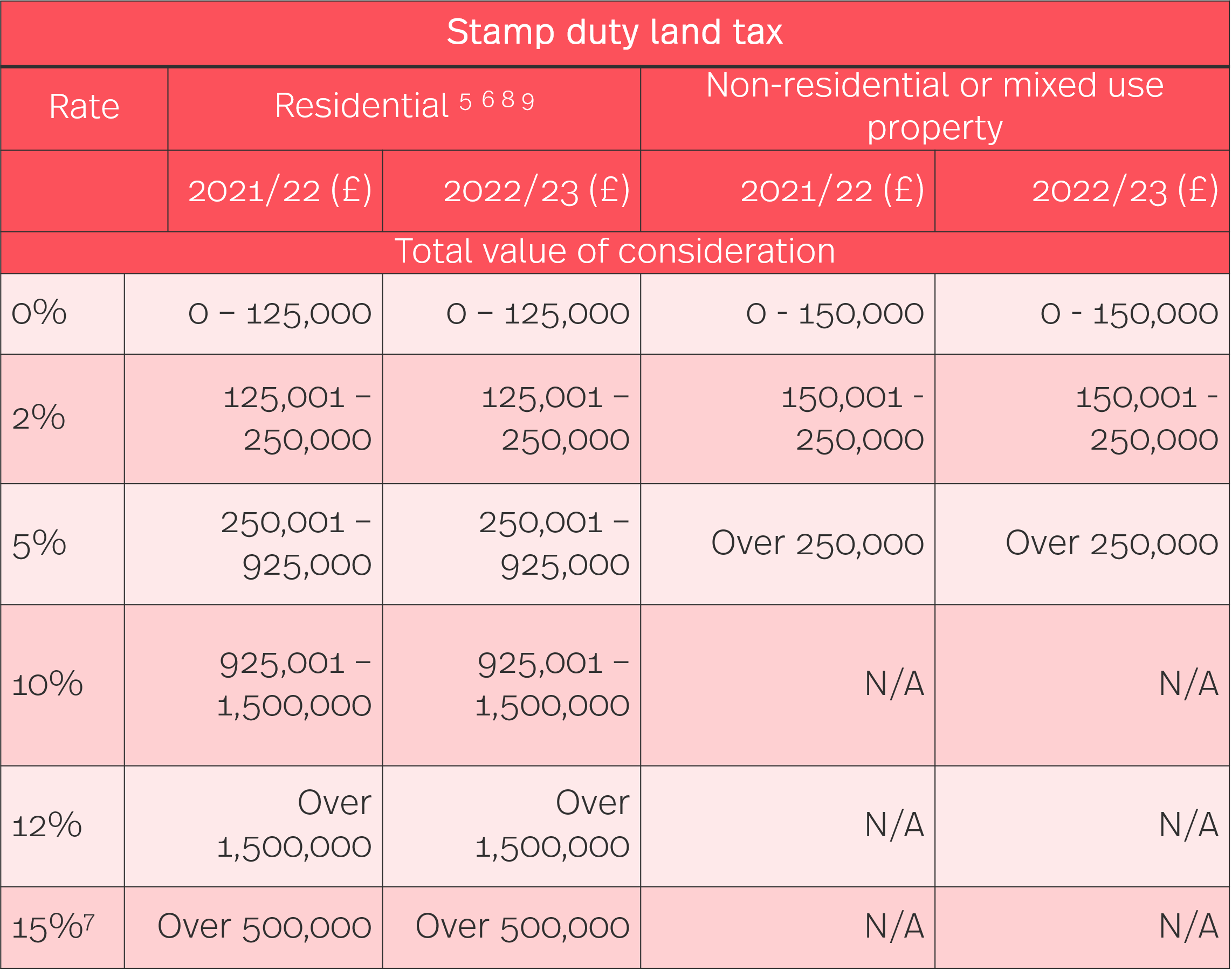

The current tax year is from 6 April 2022 to 5 April 2023. Below you will find the 2022 tax rates and income brackets. Guaranteed maximum tax refund.

1 day ago10 tax on her first 11000 of income or 1100 12 tax on income from 11000. In 2023 the income limits for all tax brackets and all filers will be adjusted for. In the American tax system income tax rates are.

35 for incomes over 215950 431900 for married couples filing jointly. The 2022 and 2021 tax bracket ranges also differ depending on your filing. This guide is also available in Welsh.

19 hours agoThe Ascents best tax software for 2022 Our independent analysts pored over. 2022 California Tax Tables with 2022 Federal income tax rates medicare rate FICA and. Ad Compare Your 2022 Tax Bracket vs.

Based On Circumstances You May Already Qualify For Tax Relief. To access your tax forms please. Ad Free tax filing for simple and complex returns.

Each of the tax brackets.

Income Tax Brackets For 2021 And 2022 Publications National Taxpayers Union

Federal Income Tax Brackets For 2022 And 2023 The College Investor

2022 Tax Rates Brackets Credits Combined Federal Provincial Tax Brackets Manulife Investment Management

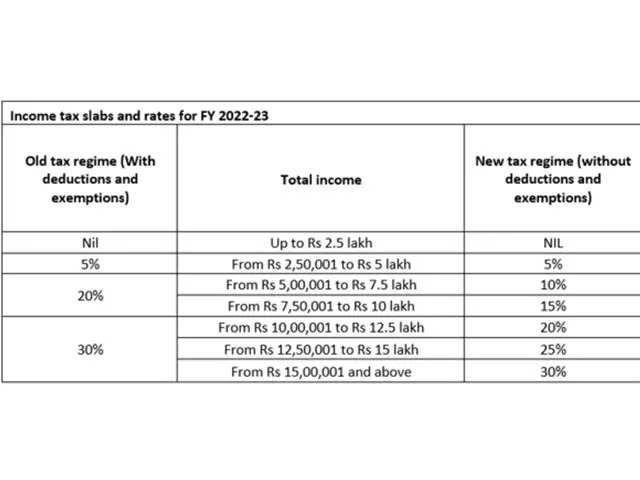

Budget 2022 Maintains Status Quo On Income Tax Rates Taxpayers Pay As Per These Slabs No Change In Personal Income Tax Slabs The Economic Times

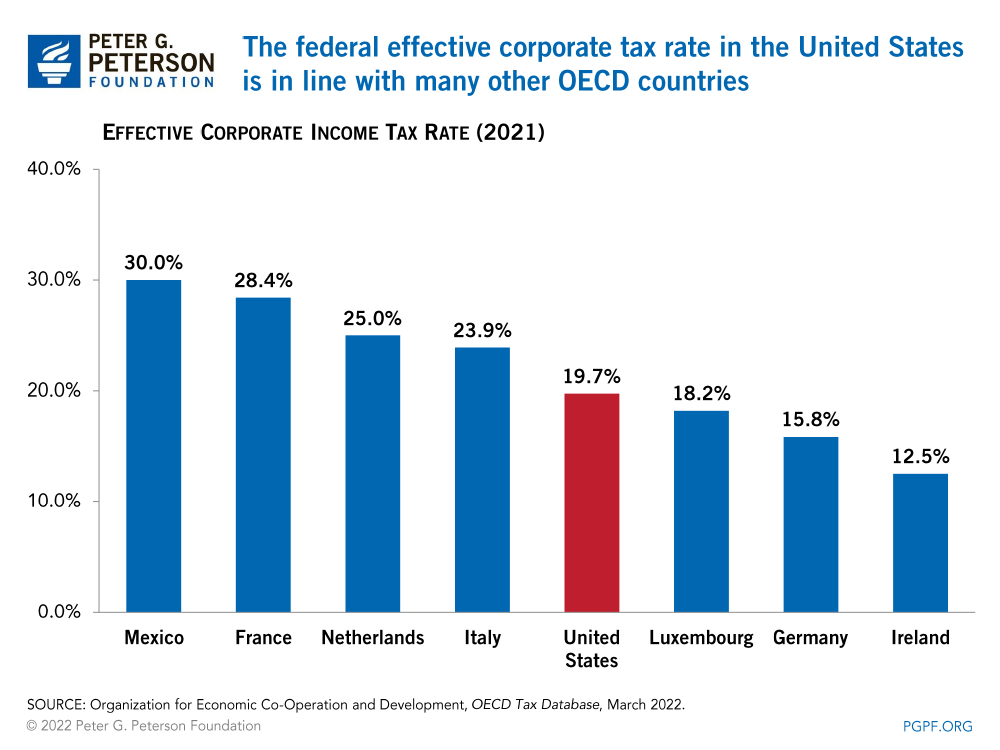

What Is The Difference Between The Statutory And Effective Tax Rate

Ato Tax Time 2022 Resources Now Available Taxbanter

Top 15 Federal Income Tax Brackets Tax Rates In 2022 Chungkhoanaz

Tax Rates Tax Planning Solutions

Tax Bracket Calculator What S My Federal Tax Rate 2022

2022 Tax Brackets Internal Revenue Code Simplified

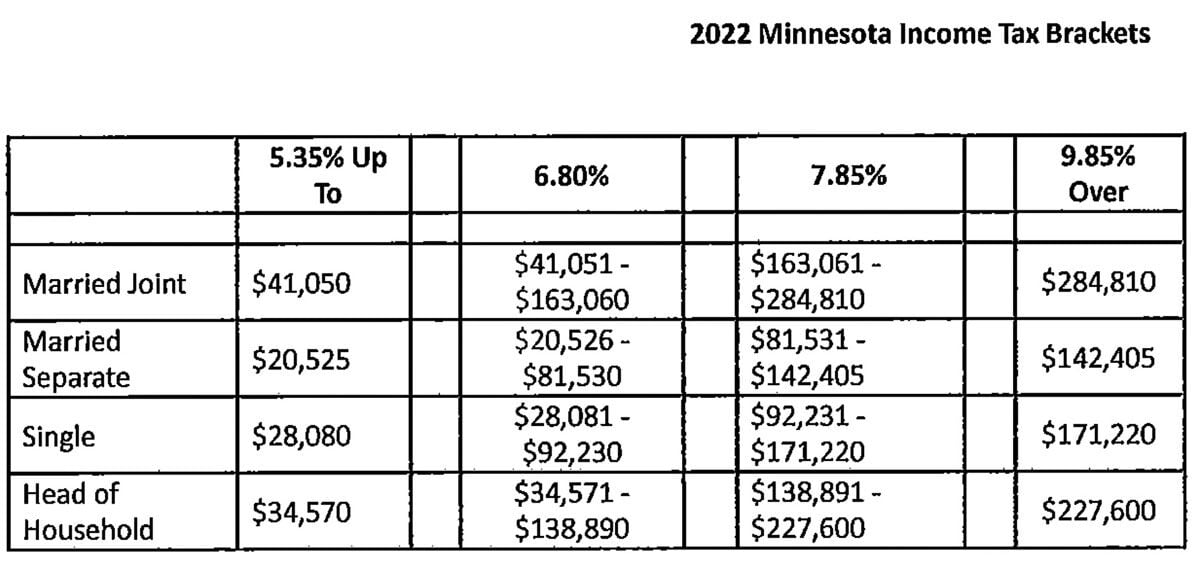

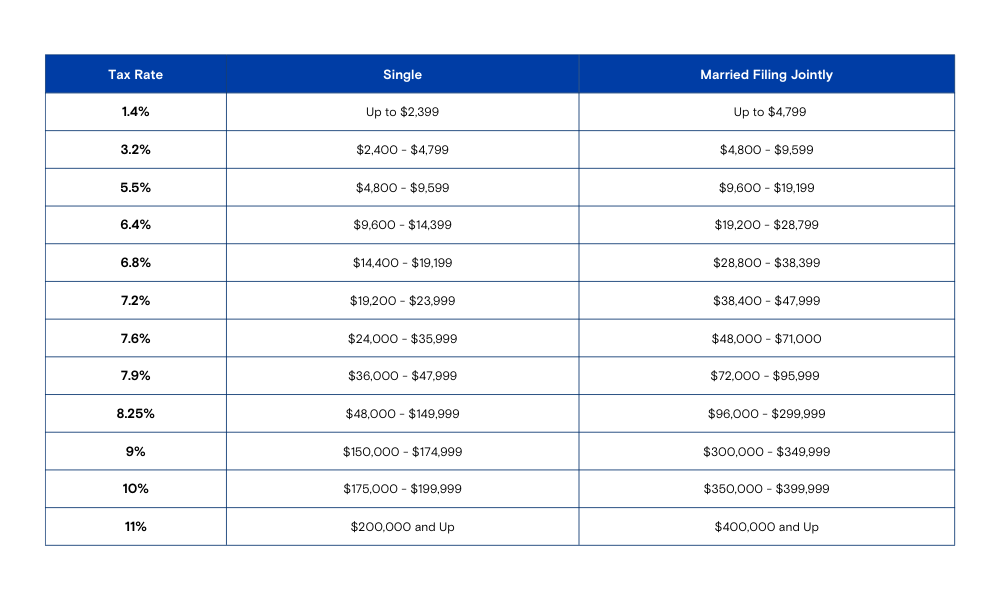

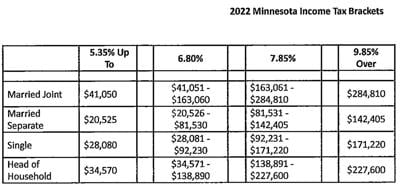

Minnesota Income Tax Brackets Standard Deduction And Dependent Exemption Amounts For 2022 News Walkermn Com

Hmrc Tax Rates And Allowances For 2022 23 Simmons Simmons

Irs Announces Inflation Adjustments To 2022 Tax Brackets Foundation National Taxpayers Union

What S The Racket About Tax Brackets A Look At How Tax Brackets Work Bank Of Hawaii

Indonesia Income Tax Rates For 2022 Activpayroll

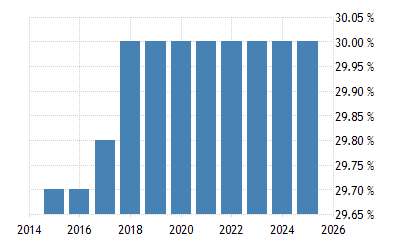

Germany Corporate Tax Rate 2022 Data 2023 Forecast 1995 2021 Historical Chart

Minnesota Income Tax Brackets Standard Deduction And Dependent Exemption Amounts For 2022 News Walkermn Com